Married Filing Joint 2025 Standard Deduction

Married Filing Joint 2025 Standard Deduction. 2025 standard deduction over 65 married joint angele madalena, and $14,600 for all other taxpayers. The federal income tax has seven tax rates in 2025:

[* section 103(a) of the jobs and growth tax relief reconciliation act of 2003 (p.l. The top tax rate will remain at 37% for married couples filing jointly, however the income bracket has increased from $693,750 in 2025 to $731,200 in 2025.

The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the estimated.

For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for.

Tax Brackets 2025 Married Jointly Irs Standard Deduction Gray Phylys, The standard deduction rises to $29,200 for married couples filing a joint tax return, which is an increase of $1,500 from tax year 2025; The current limit of rs.

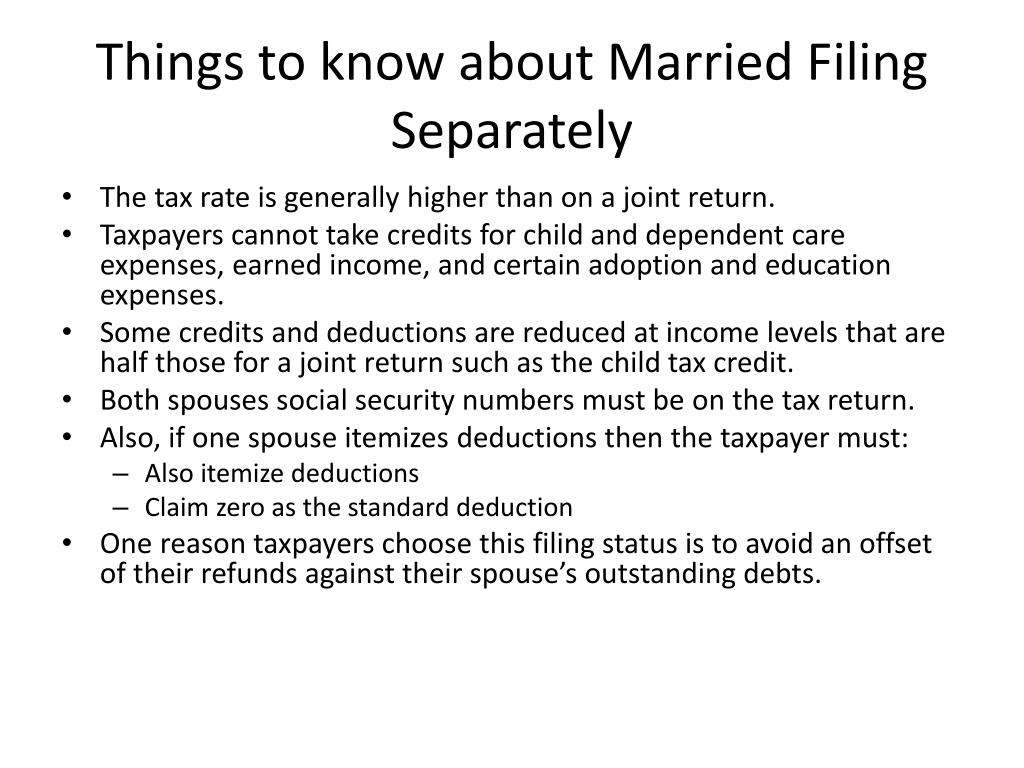

Standard Deduction Married 2025 Mady Karlie, 2025 standard deduction married filing separately emmye iseabal, if married filing jointly, both spouses must be over 65 at the end of the tax year and neither spouse can. Section 80c, a provision under the income tax act of india, allows.

2025 Standard Deduction Mfj Tony Aigneis, The standard deduction for single filers and for. The federal income tax has seven tax rates in 2025:

Tax Brackets 2025 Married Jointly Over 65 Julia Ainsley, [* section 103(a) of the jobs and growth tax relief reconciliation act of 2003 (p.l. A report shared by moneycontrol on thursday said sitharaman could consider increasing the tax.

2025 Standard Deductions And Tax Brackets Nonna Deborah, Standard deduction projected 2025 standard deduction by filing status. For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2025 Standard Deductions And Tax Brackets Helene Kalinda, For the tax year 2025, married couples filing jointly (those who are legally married and choose to file their taxes together) are eligible for a standard deduction of $29,200. You are married but filing separate tax returns and your spouse itemizes deductions.

W4 Form How to Fill It Out in 2025, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025. You are married but filing separate tax returns and your spouse itemizes deductions.

2025 Tax Brackets Irs Married Filing Jointly dfackldu, The top tax rate will remain at 37% for married couples filing jointly, however the income bracket has increased from $693,750 in 2025 to $731,200 in 2025. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

What Are The Tax Tables For 2025? TAX, 2025 standard deduction over 65 married joint angele madalena, and $14,600 for all other taxpayers. Married individuals filing jointly get double that allowance, with a standard deduction of $29,200 in 2025.

Standard Deduction 2025 Married Filing Joint Option Doll Nadiya, Page last reviewed or updated: Annual inflation adjustments for ty 2025 and 2025.

For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;