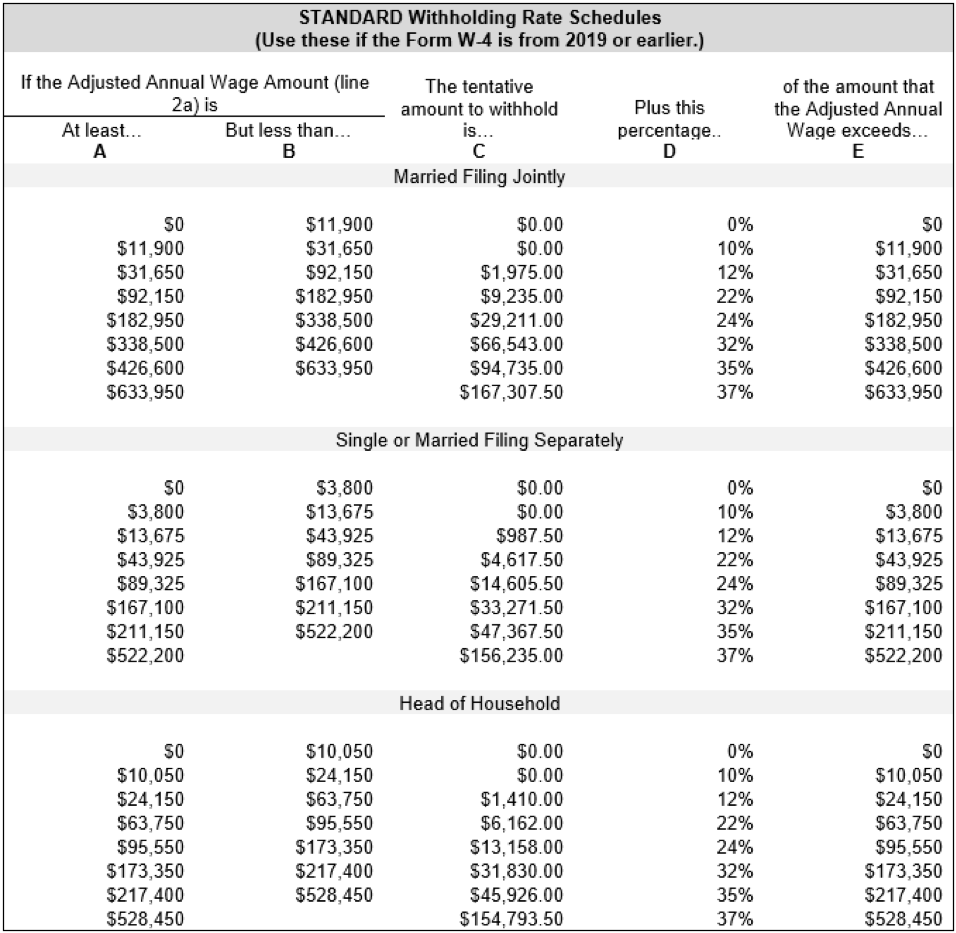

Fica And Medicare Tax Rate 2025 Schedule

Fica And Medicare Tax Rate 2025 Schedule. Federal insurance contributions act (fica) the wage base will increase from $160,200 to $168,600. You’re typically responsible for paying half.

There is no limit to wages subject to the medicare tax. For employees, the fica tax rate is 7.65%, split between social security and medicare.

2025 Fica And Medicare Tax Rates In Hindi Coleen Silvie, The fica tax rate, which is the combined social security rate of 6.2 percent.

2025 Fica And Medicare Tax Rates In India Cymbre Lucretia, Fica is a payroll tax, and it's short for the federal insurance contributions act.

2025 Medicare Tax Rates And Limits Flori Jillane, In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee.

Difference Between Medicare And Fica, In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Fica And Medicare Withholding Rates For 2025 Withholding Juli Valentina, Fica stands for the federal insurance contributions act, and.

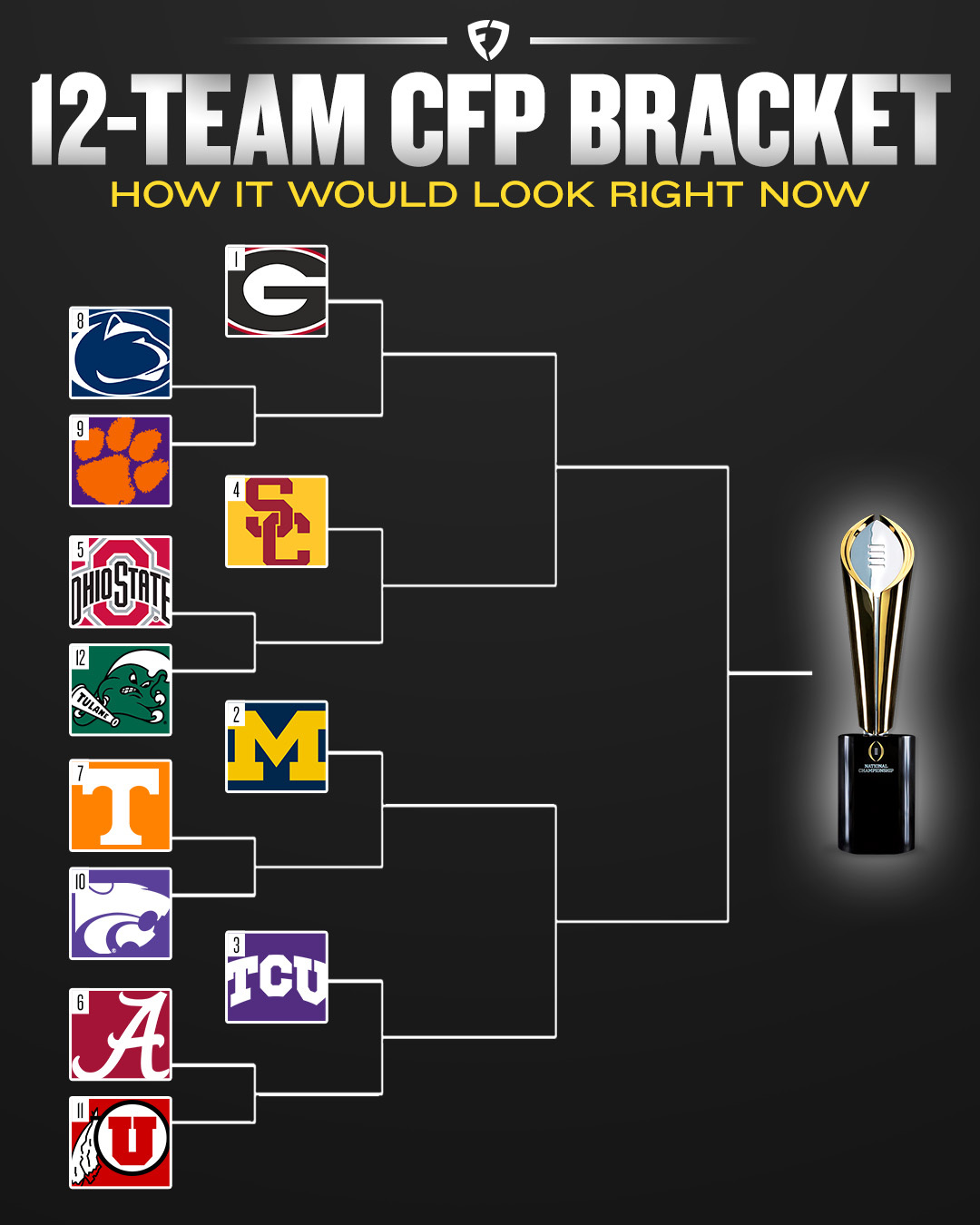

Cfp Schedule 202425 Tax Judy Sabine, Fica stands for the federal insurance contributions act, and.

Cfp Schedule 202425 Tax Judy Sabine, Under current law, the tax rate will remain the same at the rate of 6.2% to be paid by both the employer and the.

Connections Hints Jan 4 2025. Solve connections first, or scroll at your own risk. It’s wednesday, and you know what that means: That’s why we […]

Doctors Day 2025 Wishes. December 08, 2025 14:30 ist. Happy doctors day 2025 wishes. Celebrating the incredible doctors who heal with their hands and hearts. […]

Dubai Invitational 2025 Leaderboard. The tournament starts at the thursday, 11th of january and ends at the sunday, 14th. With podium finishers taking home $50,000 […]